Click a term for more information:

Need for Protection

View the “true” facts about income-interrupting disabilities.

Emotional impact versus insurance protection for various events.

A disability can happen to anyone…at any time.

- In the last 10 minutes, 490 Americans became disabled.

– National Safety Council®, Injury Facts® 2010 Ed. - In 2008, there were 2.1 million disabling injuries caused by a motor vehicle accident; there were 39,000 fatal motor vehicle accidents.

– National Safety Council®, Injury Facts® 2010 Ed. - In the U.S., a disabling injury occurs every 1 second, a fatal injury occurs every 4 minutes.

– National Safety Council®, Injury Facts® 2010 Ed. - In the home a fatal injury occurs every 12 minutes and a disabling injury every 3 seconds.

– National Safety Council®, Injury Facts® 2008 Ed. - There is a death caused by a motor vehicle crash every 12 minutes; there is a disabling injury every 13 seconds.

– National Safety Council®, Injury Facts® 2008 Ed. - At age 40, the average worker faces only a 14 percent chance of dying before age 65 but a 21 percent chance of being disabled for 90 days or more.

– Insurance Information Institute, www.iii.org November, 2005 - The probability of a white-collar worker becoming disabled for 90 days or longer between the ages of 35 and 65 is 27% for men and 31% for women.

– Millman, sponsored by Life and Health Insurance Foundation for Education (LIFE), “The Real Risk of Disability in the United States”, 2007 - 43% of all people age 40 will have a long-term disability event prior to age 65.

– JHA Disability Fact Book, 2008 - 51.2 million Americans have some level of disability. They represent 18% of the population.

– U.S. Census Bureau, July, 2006 - The number of disabled workers in America has risen by 35% since 2000.

– Social Security Administration, 2007 - Almost 3 in 10 workers entering the workforce today will become disabled before retirement.

– Social Security Administration, Fact Sheet, January 31, 2007 - In 2007, the employment rate of working-age people with disabilities in the U.S. was 36.9%.

– U.S. Census Bureau, American Community Survey, 2007 - A new Harvard University report reveals that 62 percent of all personal bankruptcies filed in the U.S. in 2007 were due to an inability to pay for medical expenses.

– June 4, 2009. The American Journal of Medicine - Unfortunately, most Americans have little understanding of the likelihood of experiencing a disability. A recent CDA survey of workers found:

- 90 percent underestimate their own chances of becoming disabled.

- 85 percent express little or no concern that they might suffer a disability lasting three months or longer.

- 56 percent do not realize that the chances of becoming disabled have risen over the past five years.

– Council for Disability Awareness, 2007 Disability Awareness Survey

Retirement Protection and American Savings Patterns

Most Americans can’t afford to become disabled.

- In 2007, the median income of households that include any working-age people with disabilities in the U.S. was $38,400.

– U.S. Census Bureau, American Community Survey, 2007 - Over 70% of working Americans do not have enough savings to meet short-term emergencies.

– National Investment Watch Survey, A.G. Edwards Inc., 2004 - Over 50% of the workforce has no private pension coverage and a third have no retirement savings.

– Social Security Administration, Fact Sheet 2007 - 71% of American employees live from paycheck to paycheck.

– American Payroll Association, “Getting Paid in America” Survey, 2008 - Only 40% of adult Americans have separate emergency savings funds.

– National survey commissioned by the Consumer Federation of America (CFA) and carried out by Opinion Research Corporation, February 2007 - More than 35% of workers with 401(k) or IRA plans have not thought about or don’t know what would happen to their contributions if they were unable to earn an income for a period of time.

– Council for Disability Awareness, 2007 Disability Survey

Causes of Disability

Illnesses generally cause disabilities, not accidents.

- 90% of disabilities are caused by illnesses.

– JHA Disability Fact Book, 2008 Edition - Over 85% of disabling accidents and illnesses are not work related.

– National Safety Council®, Injury Facts® 2008 Ed. - While many people think that disabilities are typically caused by freak accidents, the majority of long-term absences are actually due to illnesses, such as cancer and heart disease.

– Life and Health Insurance Foundation for Education November, 2005 - For insured men and women in their prime working years (30-59), the medical conditions causing the most disabilities are cardiovascular problems, musculoskeletal conditions and cancer. One notable exception is the impact of pregnancy on female disability risk. Among women ages 30-39, disabilities due to pregnancy (mostly complications of pregnancy) are the most prominent claim type.

– Millman, sponsored by Life and Health Insurance Foundation for Education (LIFE), “The Real Risk of Disability in the United States”, 2007 - Stroke is a leading cause of serious long-term disability.

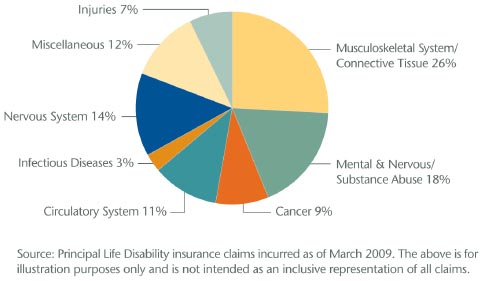

– Centers for Disease Control and Prevention, 2007 - Common causes of individual disability insurance claims are:

Disability Duration

An average disability may last longer than you think.

- In 2008, the majority of Principal Life’s individual disability claims had been active for 5-10 years. The effects of a disability are mostly long-term:

Duration % of Active Claims 10+ years 21.10% 5 to 10 years 30.20% 2 to 5 years 17.90% 2 years 16.20% 1 year or less 12.70% - The average duration of a long-term disability is 30 months.

– JHA Disability Fact Book, 2006 - Nearly 1 in 5 Americans will become disabled for 1 year or more before the age of 65.

– Life and Health Insurance Foundation for Education. November 2005 - Three out of 10 workers between the ages of 25 and 65 will experience an accident or illness that keeps them out of work for 3 months or longer.

– Social Security Administration, Fact Sheet, January 31, 2007 - Nearly 1 in 3 Americans ages 35-65 will become disabled for more than 90 days

– 2005 Field Guide to Estate Planning, Business Planning & Employee Benefits, by Donald Cady

Disability Costs

Indirect and direct costs of a disability take financial tolls on everyone.

- One work-related disabling injury costs an employer on average $48,000.

– National Safety Council®, Injury Facts® 2010 Ed

.

- Off-the-job injuries to workers cost the nation at least $253.3 billion and 225 million days of production time in 2008.

– National Safety Council®, Injury Facts® 2010 Ed. - The average disability absence results in payments of $3,800, while lost productivity costs on average over $22,800.

– Integrated Benefits Institute, IBI News September 8th, 2006 - Employers spend 4.1% of payroll on unscheduled absences.

– Marsh/Mercer Health & Benefits, “Health, Productivity and Absence Management Programs,” 2006 Survey report - In 2006, unscheduled absence cost some large employers an estimated $850,000 per year in direct payroll.

– CCH and Harris Interactive, “2006 CCH Unscheduled Absence Survey,” October 2006 - Disabling injuries and illnesses account for 55% of employee absences.

– JHA 2005 Absence Management Survey, “Big-picture benefits: Integrating FMLA and disability claims data helps reduce absenteeism,” by Chris Silva, September 2006 - Just 10% of disability cases account for more than half the total medical and disability costs.

– Integrated Benefits Institute, IBI News September 8th, 2008

Misconceptions

Common back-up plans to loss of income may not be an option.

- Nearly three-fourths of disabling injuries in 2008 are not work related, and therefore not covered by workers’ compensation.

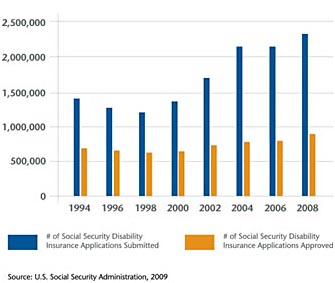

– National Safety Council®, Injury Facts® 2010 Ed. - Less than half – 35% – of the 2.8 million workers who applied for Social Security Disability Insurance (SSDI) benefits in 2009 were approved.

– Social Security Online, disabled worker beneficiary statistics, ssa.gov - The average monthly SSDI benefit is $1,064.

– Social Security Administration, Monthly Statistical Snapshot, December 2009, ssa.gov - Comparison of Social Security disability insurance applications to the amount approved:

- In 2007, the percentage of working-age people with disabilities receiving SSDI payments in the US was 17.1%.

– U.S. Census Bureau, American Community Survey, 2007 - Over 6.8 million workers are receiving SSDI benefits, almost half are under age 50. This represents only 13% of the over 51 million Americans classified as disabled.

– Social Security Administration, Fact Sheet 2007

Market Opportunity

There is a need for disability insurance.

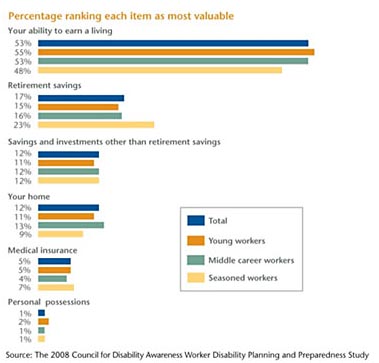

- Workers’ rankings of the most valuable activities to achieve long-term financial security:

- 43% of employees indicated protecting financial assets due to an unexpected event as a main concern.

– The Principal Financial Well-Being IndexSM, 2009 - 61% of employees surveyed said good employee benefits encourage them to work harder and perform better; 61% said good benefits keep them working for their current employer.

– The Principal Financial Well-Being IndexSM, 2010 - Fewer than one in three (29%) U.S. workers have private long-term disability coverage.

– National Compensation Survey, Bureau of Labor Statistics, 2006 - 70% of the private sector workforce has no long-term disability insurance. – Social Security Administration, Fact Sheet 2007

- Only 30% of American workers in private industry currently have access to employer-sponsored long-term disability insurance coverage.

– National Compensation Survey: Employee Benefits in Private Industry in the United States, U.S. Department of Labor, Bureau of Labor Statistics, March 2006. - The odds of selling a product to a new customer are 15 percent, while the odds of selling to an existing customer are 50 percent.

– Raymond Adamson, Cross-Sell to Success, Advisor Today, March 2005 - The top reason producers are not selling IDI is because their clients do not ask about the product.

– LIMRA International, “Producer Perspectives on Individual Disability Insurance”, 2009 - Despite the fact that more than 70% of American households rely on two incomes to make ends meet, only 26% of Americans have any type of disability insurance.

– Facts from LIMRA May 2010 Multimedia Fact Sheet, based on findings from LIMRA’s life insurance consumer studies. - Only 18% of consumers recall being approached about buying disability insurance – less than half as many as those being approached for life insurance.

– Facts from LIMRA May 2010 Multimedia Fact Sheet, based on findings from LIMRA’s life insurance consumer studies. - Only 13% of small business owners have disability income insurance.

– Facts from LIMRA May 2010 Multimedia Fact Sheet, based on findings from LIMRA’s life insurance consumer studies. - Who buys disability insurance? While men represent the majority of new sales, sales to females grew at a slightly faster rate than sales to males in 2008. Older age groups bought more policies in 2008, with an increase in both the 50-59 and 60+ age groups.

– Facts from LIMRA May 2010 Multimedia Fact Sheet, based on findings from LIMRA’s life insurance consumer studies.

Education Related

There is a clear need for more information and education about solutions that are available to help during a disability.

- From the CDA 2009 Worker Disability Planning and Preparedness Study:

- Only one in three workers surveyed associate financial planning with protecting assets and income (38%), tax planning (33%), or saving for a home purchase (32%).

- Nearly nine in ten workers surveyed believe that people should plan in their 20s or 30s in case an income limiting disability should occur (86%). Only half of all workers have actually planned for this possibility (50%), and only half have even discussed disability planning (46%).

- When surveyed what is most valuable in helping them achieve long-term financial security, far more workers rank their ability to earn a living as number one (53%) than assets such as retirement savings (17%), other savings and investments (12%), their home (12%), medical insurance (5%), or personal possessions (1%).

- The large majority of workers are concerned about how they would pay their living expenses if they were disabled (82%), yet most are not prepared if such a disability were to extend for any significant length of time. Seven in ten could cover their expenses for six months or less.

- 66% of executives surveyed believe that providing financial advice at the workplace is more important than it was a year ago.

– Charles Schwab & Co. June 2009 - 76% of employed baby boomers and 68% of employed Generation Y workers say that the employer is among the most reliable sources of information about benefits.

– Harris Interactive Survey 2008 - Only 5% of baby boomers realize they have a 34% chance of becoming disabled during their working years.

– Harris Interactive/AHIP, Baby Boomers’ Awareness of Disability Risks, February 2008 - 45% of employees feel not at all knowledgeable about individually owned disability insurance.

– Principal Well-Being Index, 1QTR 2009 - 14% of employees personally own a disability income insurance policy on themselves, a significant decrease from 1st quarter 2008 when 18% reported owning such a policy. Only 7% of employees’ spouses own a disability income insurance policy.

– Principal Well-Being Index, 1QTR 2009

Business Related

There is a need for disability insurance solutions for businesses.

- The U.S. had 5.8 million small business employers in 2009, representing over 99 percent of the nation’s employers.

– Small Business Administration Office of Advocacy, 2010 - In 2009, outstanding small business loans (under $1 million) were valued at over $685.4 billion for more than 23 million loans.

– Small Business Administration Office of Advocacy, 2010 - Half of business owners do not have any disability plans in place for either themselves or their key employees (50%).

– The Principal Financial Group Business Priorities Market Research, January 2009 - Nearly three quarters of business owners indicated that they or their key employees are limited in the amount they are allowed to contribute to their qualified retirement plan (73%). Yet, very few business owners offer supplemental retirement plans (83% do not offer any plans) that can help overcome this limitation.

– The Principal Financial Group Business Priorities Market Research, January 2009 - About 43% of wealthy business owners (almost double the percentage of other affluent Americans questioned) said they would work to age 70 or later, but only one-third of these owners said they have written succession plans in place.

– Private Wealth magazine, April-May 2008; survey by PNC Wealth Management, Philadelphia, PA