When an unexpected illness or injury interferes with a person’s ability to earn an income the consequences are serious. In your year-end meetings with your clients, ask them if they have paycheck protection. Help them understand the liklihood and the consequenses of a disabling illness or injury, especially in this country.

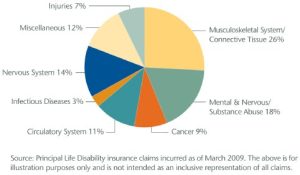

According to the Council for Disability Awareness, more than 25% of today’s 20-year-olds can expect to be out of work for at least a year due to a disabling event during their entire career. Furthermore, almost 6% of working Americans suffer short-term disablement every year. Contrary to popular opinion, disabilities don’t usually come from freak accidents or unlucky work-related injuries. Most clinical short and long-term disablements are non-occupational and arise from illnesses or degenerative disorders like cancer, heart disease, diabetes and muscular and skeletal degeneration.

Furthermore, common back-up plans, such as Social Security Disability or Workman’s Compenstion, to loss of income may not be an option. The financial consequences of disability are serious. Over 380,000 Americans filed for bankruptcy last year with the primary underlying causes being medical bills, lost employment and illness or injury. Employer-provided worker’s compensation and governmental benefits hardly provide substantial monetary relief for most occurrences of disablement. The practical solution is individual and/or group disability insurance at levels sufficient to provide for oneself and one’s family in time of unforeseen and unexpected loss of ability to work and earn an income.

Despite the fact that more than 70% of American households rely on two incomes to make ends meet, only 26% of Americans have any type of disability insurance. Yet, Only 18% of consumers recall being approached about buying disability insurance – less than half as many as those being approached for life insurance. The top reason producers are not selling IDI is because their clients do not ask about the product.

Just Ask!

When you partner with Source Brokerage, Inc., we can help you tailor disability income solutions to fit the unique needs of your clients. We provide multiple quotes, walk you through each quote and the application process, and follow the application through underwriting until the policy is placed in force. We assist our brokers throughout the process so they have a much higher success rate placing policies in force.

It’s a Win-Win!

You do what you do best–advise your clients, and we do what we do best–disability insurance!

Questions? We have the answers! Let’s get started! Contact Steve Crowe at ext. 222, or request a quote.